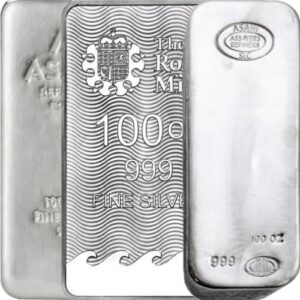

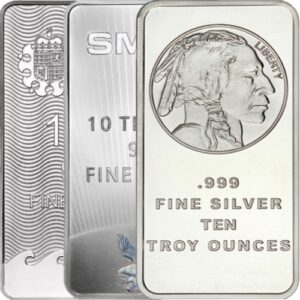

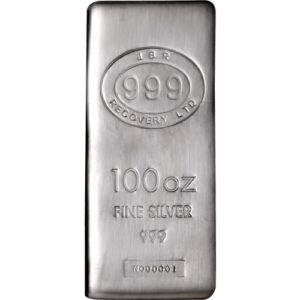

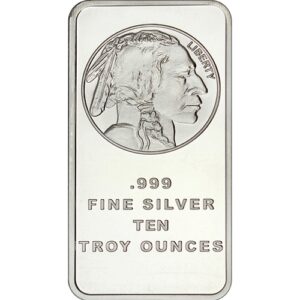

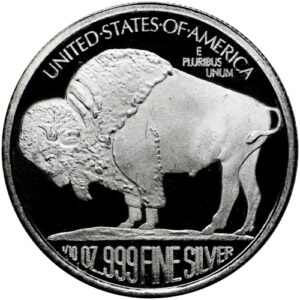

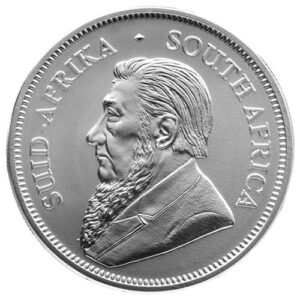

Silver bullion refers to silver that is officially recognized as being at least 99.9% pure and is sold in bars, rounds, or coins. Bullion is primarily valued by its weight and purity rather than its face value or artistic design. It is considered a tangible asset for investors seeking to diversify their portfolios or hedge against economic uncertainty.

Investors and collectors typically purchase silver bullion for its intrinsic value as a store of wealth and as a hedge against inflation, currency devaluation, and economic instability. Additionally, some people purchase silver bullion for it's relatively lower premium over spot compared to a numismatic or collector coin. Bullion is also widely recognized for it's purity, and therefore can easily be offloaded when it comes time to sell.

Please read our Risk Disclosure before purchasing.

We respect your privacy. Your data will not be shared or sold.

* By submitting the form above, you authorize Metals Edge or someone acting on its behalf to contact you for marketing & sales purposes. Message and Data rates may apply. Reply with STOP to opt-out.

We respect your privacy. Your data will not be shared or sold.

* By submitting the form above, you authorize Metals Edge or someone acting on its behalf to contact you for marketing & sales purposes. Message and Data rates may apply. Reply with STOP to opt-out.